Dependent Care Fsa Limit 2025 Income 2025 - To sum it up, budget 2025 could see significant changes aimed at making the new income tax regime more attractive by increasing deductions and raising exemption limits, thereby providing greater relief and incentives for taxpayers to switch. Affordable Health Care Limits 2025 Devin Feodora, The amount goes down to $2,500 for married people filing separately. This is an increase of $150 from 2023.

To sum it up, budget 2025 could see significant changes aimed at making the new income tax regime more attractive by increasing deductions and raising exemption limits, thereby providing greater relief and incentives for taxpayers to switch.

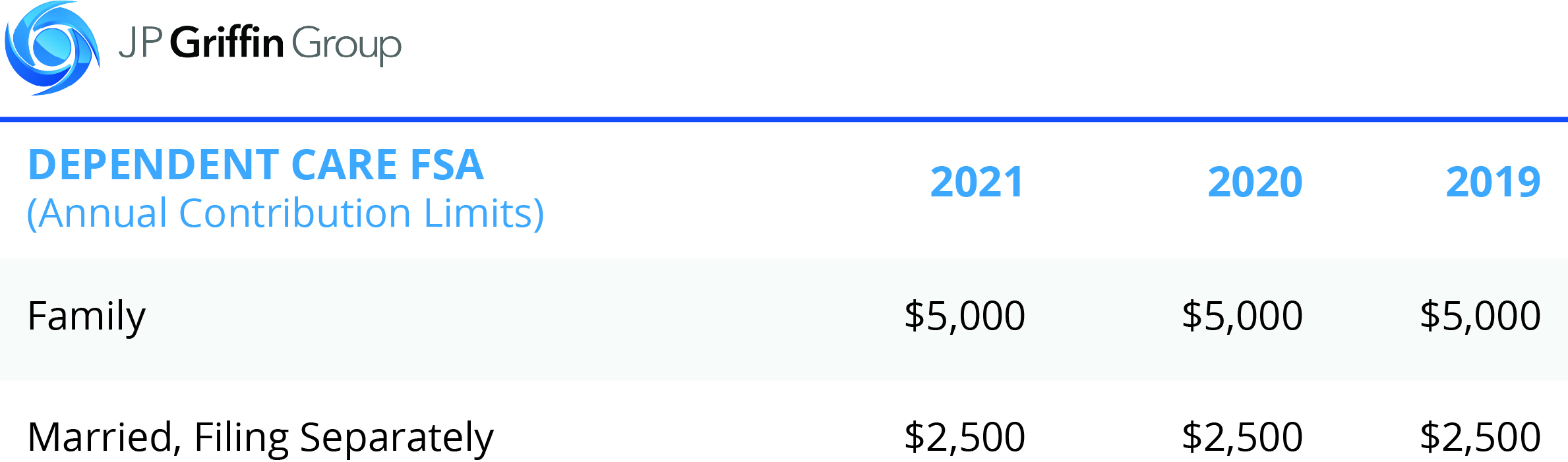

Dependent care fsa limits for 2025 the 2025 dependent care fsa contribution limit is $5,000 for “single” or “married couples filing jointly” households.

Irs Fsa Max 2025 Joan Ronica, To sum it up, budget 2025 could see significant changes aimed at making the new income tax regime more attractive by increasing deductions and raising exemption limits, thereby providing greater relief and incentives for taxpayers to switch. Dependent care fsa contribution limits for 2025.

Irs Dependent Care Fsa 2025 Jayme Loralie, An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year. Highly compensated faculty and staff (family gross earnings in 2023 of $150,000 or more) can contribute $3,600 per year.

Irs Fsa Contribution Limits 2025 Paige Rosabelle, Here is a look at four things that are on the senior citizens' budget 2025. The internal revenue service has announced that federal employees may contribute up to a maximum of $3,200 in health care or limited expense health care flexible spending accounts (fsas) in 2025.

Irs Dependent Care Fsa Limits 2025 Nissa Leland, Enter your expected dependent care expenses for the year ahead. It explains how to figure and claim the credit.

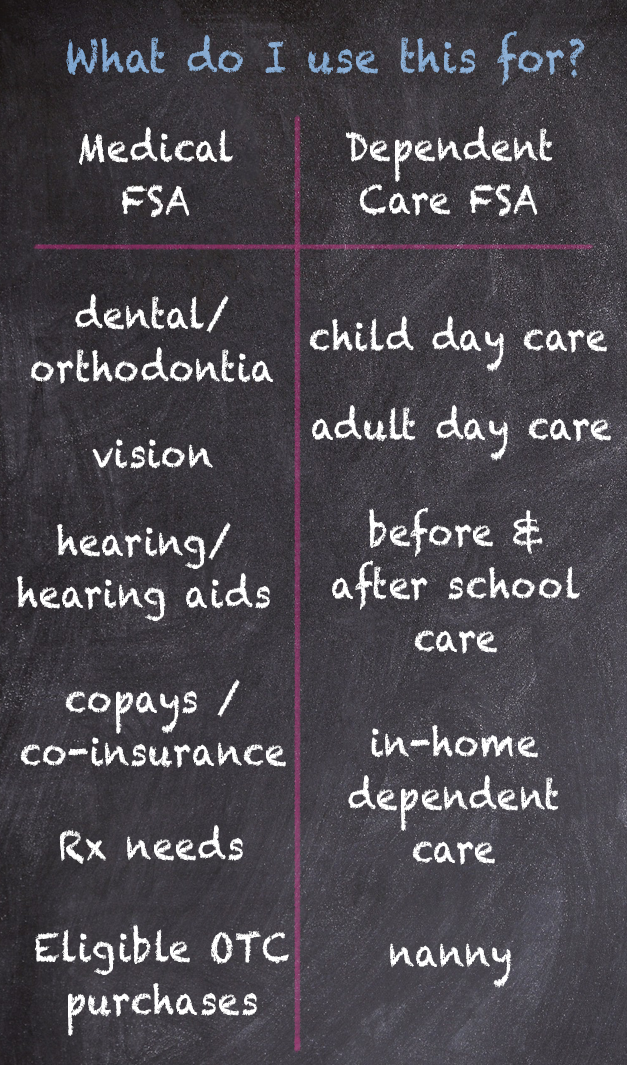

Fsa Limits 2025 Dependent Care Tera Abagail, Amounts contributed are not subject to federal income tax, social security tax or medicare tax. Dependent care fsa limit reactive cyberzine image library, the dependent care fsa (dcfsa) maximum annual contribution limit did not change for 2025.

2025 Fsa Contribution Limits Irs Tiffy Tiffie, The 2025 dependent care fsa contribution limit returned to its previous limit of $5,000 after an increase by the american rescue plan act for 2025. When submitting my updated medical benefits, there is a flagged error for my dcfsa saying my annual contribution can only be $575 in 2025 due to my income being over $150k for 2023.

Highly compensated faculty and staff (family gross earnings in 2023 of $150,000 or more) can contribute $3,600 per year.

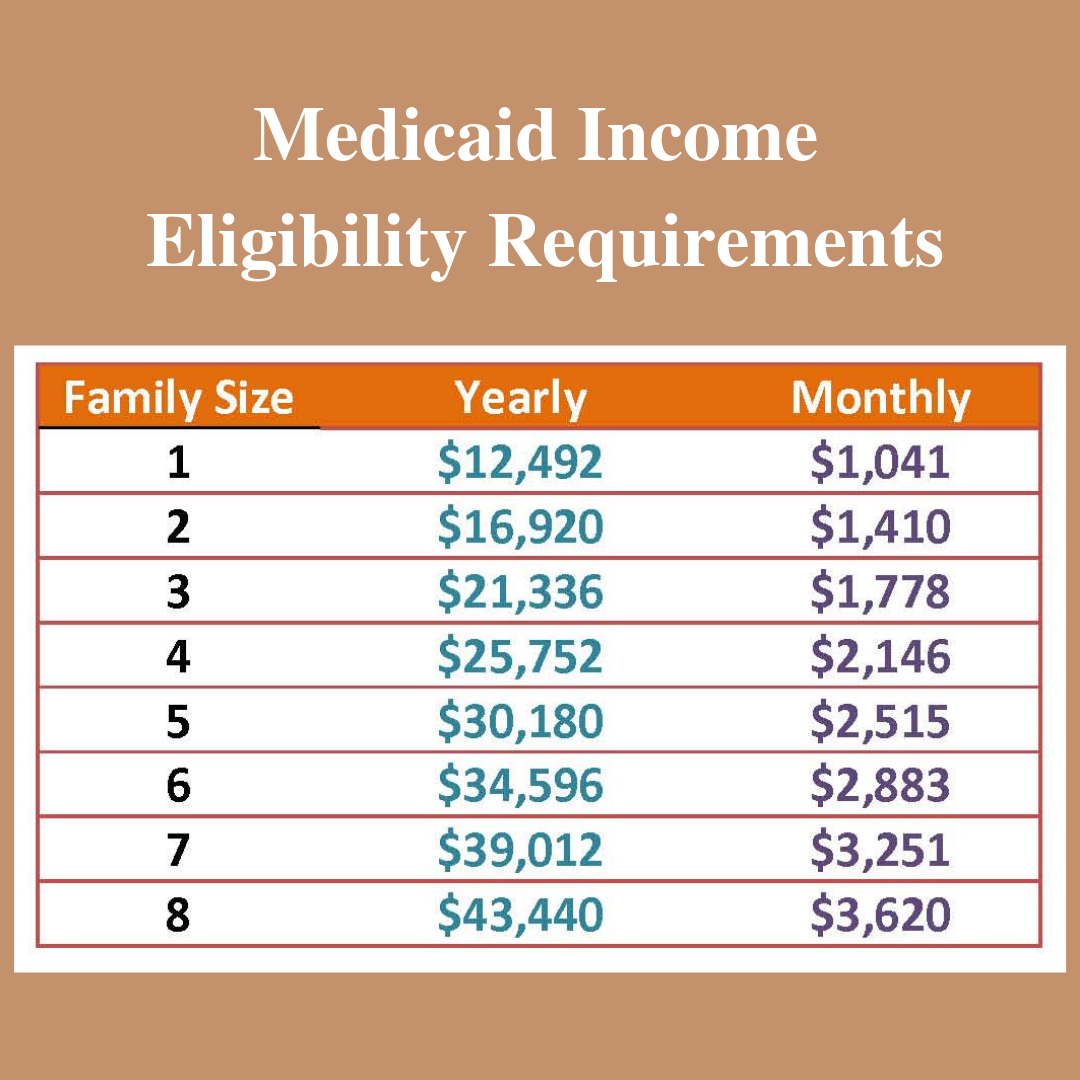

Ohp limits 2025 family of 3 dora nancee, the irs sets dependent care fsa contribution limits for each year. Highly compensated faculty and staff (family gross earnings in 2023 of $150,000 or more) can contribute $3,600 per year.

Dependent Care Fsa Limit 2025 Covid Ericka Deeanne, This publication explains the tests you must meet to claim the credit for child and dependent care expenses. It lets you set aside pretax dollars to pay for certain child and adult care services — services that allow you to work or look for work.